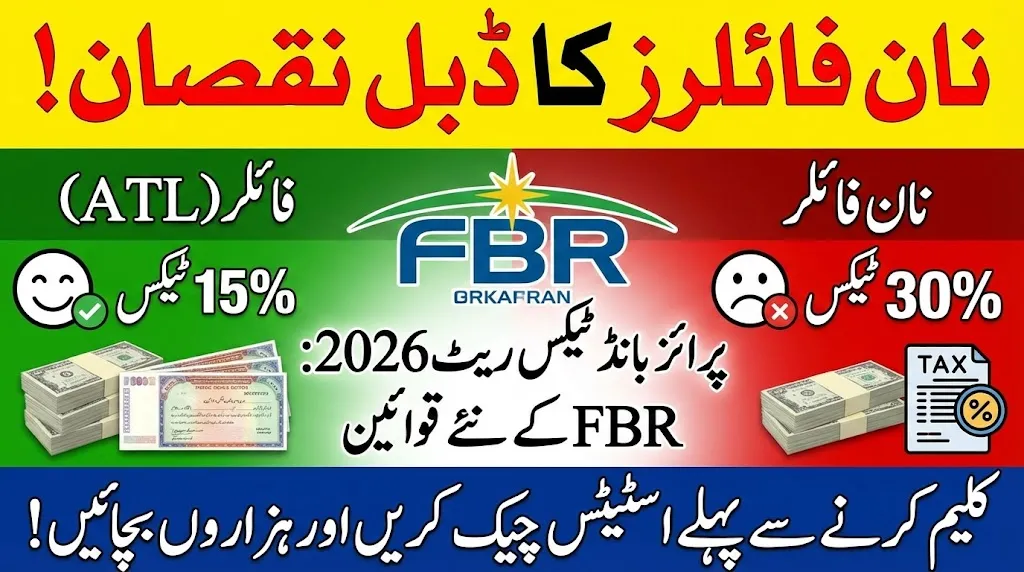

The Federal Board of Revenue (FBR) has officially confirmed the prize bond tax rate for filers and non-filers for the tax year 2026, bringing clarity for thousands of prize bond investors across Pakistan. Under the updated tax structure effective from July 1, 2025, the tax deduction on prize bond winnings continues to depend strictly on your status on the Active Taxpayers List (ATL).

If you are planning to claim a prize bond winning or waiting for draw results, understanding the correct tax rate can help you avoid heavy deductions and unexpected losses. In this article, you will learn the latest tax rates, filer vs non-filer differences, deduction rules, and important tips to save money on your prize bond winnings.

Prize Bond Tax Rates 2026 – Filers vs Non-Filers

According to the latest FBR guidelines, tax is deducted at the time of claiming your prize. The rate depends on whether you are a registered tax filer or not.

Latest Prize Bond Tax Rate Table

| Status | Tax Rate | Example (Winning Rs. 100,000) |

| Filer (ATL) | 15% | You receive Rs. 85,000 |

| Non-Filer | 30% | You receive Rs. 70,000 |

This shows that non-filers lose almost double the amount in tax compared to registered filers.

How Prize Bond Tax Is Deducted

The tax on prize bond winnings is deducted automatically.

- Deduction is done by State Bank of Pakistan (SBP) or National Savings

- Tax is deducted at the time of payment

- You do not need to deposit this tax separately

This system is called Deduction at Source, and the winner receives the remaining amount after tax.

Is Prize Bond Tax Adjustable or Refundable?

No. Prize bond winnings fall under the Final Tax Regime (FTR).

This means:

- The deducted tax is considered final

- It cannot be adjusted with other income taxes

- It cannot be refunded later

Once deducted, the amount is final and cannot be reclaimed.

Tax on Other Lucky Draw and Competition Winnings

Different tax rates apply to other types of prize money in Pakistan.

Raffles, Lotteries, Quiz Shows

- Filers: Around 20% tax

- Non-Filers: Up to 40% tax

These winnings are taxed more heavily compared to prize bonds.

Premium Prize Bonds Tax Rates 2026

For Premium Prize Bonds, which pay bi-annual profit instead of random draws, different rules apply.

Profit (Interest) Tax Rates

- Filers: 15% tax

- Non-Filers: 35% tax (increased from previous 30%)

This higher rate makes filer status even more important for premium bond investors.

How to Check Your Filer Status Before Claiming Prize

Many people unknowingly lose extra money because their ATL status is inactive.

Check Filer Status via SMS

Before claiming your prize, send this SMS:

- Type: ATL CNIC

- Send to: 8111

Example:

ATL 3520112345671

You will receive a reply showing whether you are a filer or non-filer.

Why Becoming a Filer Is Important

Being on the Active Taxpayers List gives you several benefits:

- Lower prize bond tax rate (15% instead of 30%)

- Lower tax on bank profits and investments

- Better financial record with FBR

- Easier transactions in property and banking

In many cases, becoming a filer can save thousands of rupees on a single prize.

Conclusion

The updated Prize Bond Tax Rate for Filers and Non-Filers 2026 clearly shows the financial advantage of being a registered taxpayer. With non-filers losing up to 30 percent of their winnings, checking your ATL status and becoming a filer can protect a large part of your prize money.

Before claiming your next prize, send your CNIC to 8111 and make sure you receive the maximum possible amount from your winning.